30 Clues That Let Us Know COVID Was A Planned Operation | Part IV

Gold repatriation, the repo market and interest rates.

This month, I officially hit my one-year mark on Substack. Big thanks to everyone who has supported me!

This is the fourth installment of a series exploring the many clues that reveal COVID was a planned operation. If you missed the first three, you can find them here:

Part I: Conspiracies, Anthrax, Emerging Pathogens & Informed Consent

Part II: Simulations, Comic Books & Dances

Part III: In-Q-Tel, Trump, Gates, the WHO and the FDA

While those first three parts focused mostly on bureaucrats, pandemic preparedness and predictive programming, this one will focus more on what was going on economically prior to the COVID operation.

Shall we?

20. Gold, The Repo Market & Interest Rates

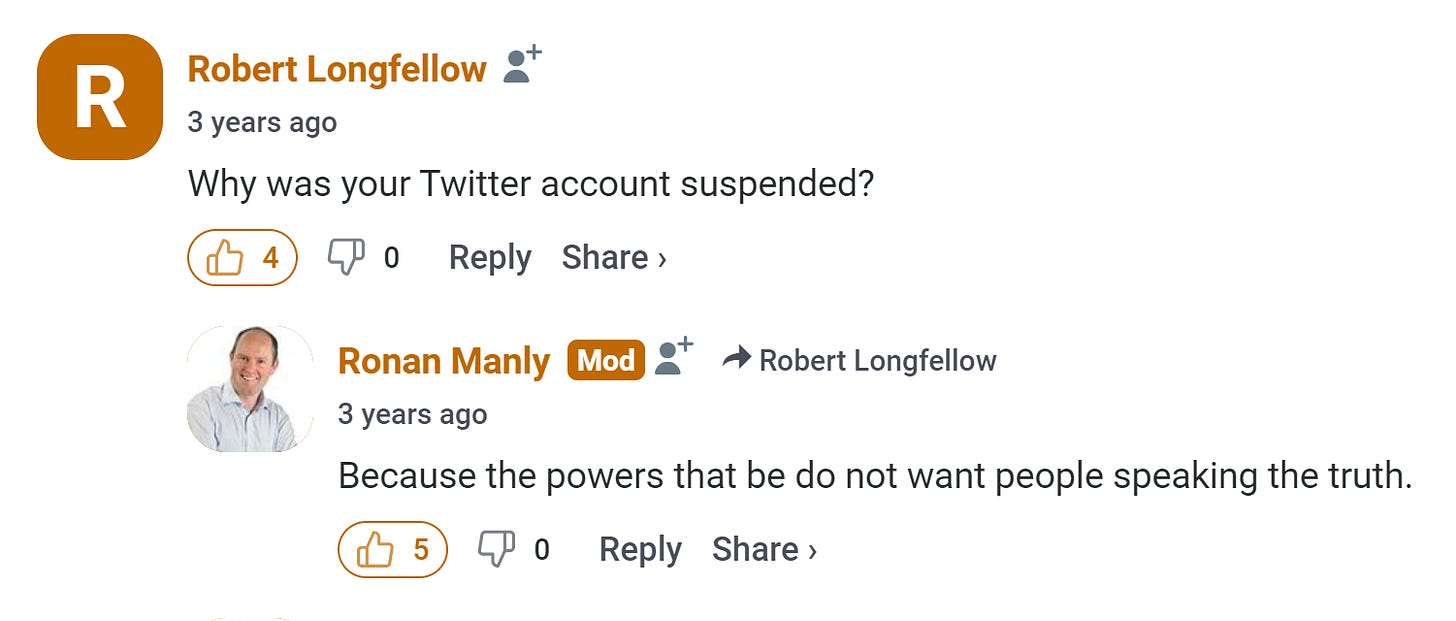

In 2013, European central banks began moving gold from New York and London to the nations of ownership. Precious metals analyst Ronan Manly points to this German press release as the first clue that there was to be a financial reset in 2020. Austria would quickly follow suit and both countries completed repatriation years ahead of schedule. The Dutch, Polish and Hungarians also had the same idea. Meanwhile, Russia’s central bank announced that it would stop buying gold for their reserves after many years of heavy activity.

Manly writes:

Beyond the central European gold repatriation club, the board of directors of the Bank for International Settlements (BIS) in Basel, Switzerland and the Ministers of Finance and central bank Governors of the Group of Ten (G10) which is also operated from the BIS offices in Basel, would be privy to a 2020 deadline for a planned financial system reset. Which is why their meeting briefs and meeting minutes are classified top secret and will never in your lifetime see the light of day.

Manly purports that the trigger for this financial reset was, of course, the COVID operation.

It looks as if Manly may have been over the target. Gold repatriation is just the tip of the iceberg, though.

In the last quarter of 2019, Wall Street banks (including but not limited to JPMorgan Chase, Goldman-Sachs and Citigroup) received $4.5 trillion in cumulative emergency repo loans for a “liquidity crisis” we’ve heard practically nothing about. The details of these transactions dropped at the very end of 2021 and media outlets opted to not cover what should be one of the biggest stories of our time.

Pam and Russ Martens write:

It was the first time the Fed had intervened in the repo market since the 2008 financial crash – the worst financial crisis since the Great Depression. The COVID-19 crisis remained months away.

So, why the silence from the media? They continue:

The most puzzling part of this news blackout is that the majority of the reporters who covered this Fed story at the time it was happening in 2019, are still employed at the same news outlets. We emailed a number of them and asked why they were not covering this important story. Silence prevailed. We then emailed the media relations contacts for the Wall Street Journal, the New York Times, the Financial Times and the Washington Post, inquiring as to why there was a news blackout on this story. Again, silence.

Next, we emailed a number of reporters who had covered this story in 2019 but were no longer employed at a major news outlet. We asked their opinion on what could explain this bizarre news blackout on such a major financial story. We received emails praising our reporting but advising that they “can’t comment.”

The phrase “can’t comment” as opposed to “don’t wish to comment” raised a major alarm bell. Wall Street megabanks are notorious for demanding that their staff sign non-disclosure agreements and non-disparagement agreements in order to get severance pay and other benefits when they are terminated. Are the newsrooms covering Wall Street megabanks now demanding similar gag orders from journalists? If they are, we’re looking at a form of corporate tyranny previously unseen in America.

John Titus from

throws in his two cents on the matter with a very educational explanation…While I do believe something happened to present a wave of illness in 2019/2020 that would allow for PCR tricks,

contributor only known as “Allen” said it best:These clues are getting juicy, eh? On to the fifth installment we go.